I have always understood the notion of holding whiskey ‘in bond,’ i.e. putting it into a warehouse for some period of time to age before excise taxes needed to be paid on it, as an implicitly good thing. In addition to deferring the taxes, it meant the whiskey could be aged longer before it needed to be sold and thus increase in value. This added value would then help offset the taxes due when the whiskey was removed from bond before, or even possibly after, being sold. However, after reading the very detailed account of the Elkhorn Distillery in Karl Raitz’ book Making Bourbon (University of Kentucky Press, 2020) [1] I realized that this boon could and did have some (possibly unintended) consequences, at least when bonding was first introduced.

This occurred in 1868 when the federal government passed an important bit of tax legislation with the imposing title of The United States Internal Revenue and Tariff Law (Passed July 13 1870) Together with the Act Imposing Taxes on Distilled Spirits and Tobacco, and for Other Purposes (July 20, 1868) et al. In addition to the new one year bonding period, the act enabled the government to create dozens of new rules and regulations that affected pretty much every aspect of distilling, from how a distillery needed to be designed and built to when and for how long operations could take place within it, along with a mountain of new paperwork that had to be filled out to ensure all these rules were being followed. It also created several new layers of bureaucracy, the most notable (and expensive) of which came in the form of requirements for direct on-premise oversight of day-to-day distillery operations. The act remade the distilling business. In particular it appears to have had the effect of making distilleries far more dependent on the cash flow needed to maintain day to day operations than they had been before. What were the causes of this change?

Dependency on cash flow

Generalizing from Raitz’ account of what happened at the Elkhorn Distillery (which eventually failed as a result [2]) the 1868 act placed two very significant fiscal burdens on distilleries:

- While taxes could now be deferred, they had to be settled as soon as the one year bonding period came to an end. Since barrels were always coming out of bond, there were taxes to be paid every month. Failure to pay on-time imposed penalties that could be higher than the taxes themselves.

- While barrels could be sold while still in bond, they could not be withdrawn for sale until they had been gauged to determine taxes owed and then not before the assessed taxes were paid.

To meet these obligations a distillery had to maintain a constant positive cash flow. [3] If they didn’t they might need to have the taxes they owed loaned to them, possibly just to close a sale. If asked, a buyer might be willing to pay the taxes ahead of a sale though the distillery then made less. Distilleries could also seek loans from banks and investors, possibly putting up barrels still in bond as collateral (AKA distillery receipts). In either case, it meant making interest payments, so distillers finding themself in this position made even less on the whiskey than normal. Once a distillery found itself in such a cycle, it could be hard to break out into a cash positive situation again.

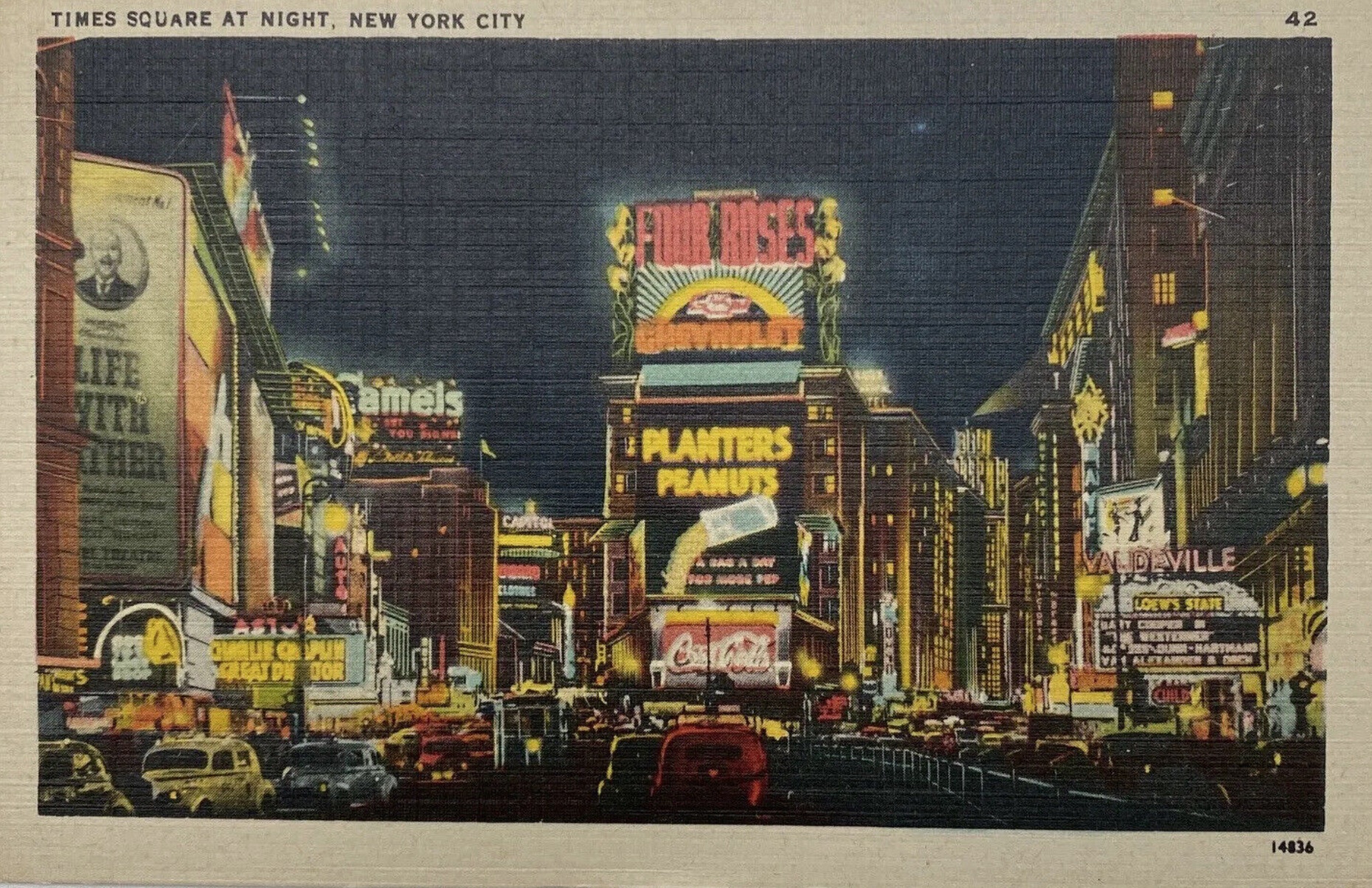

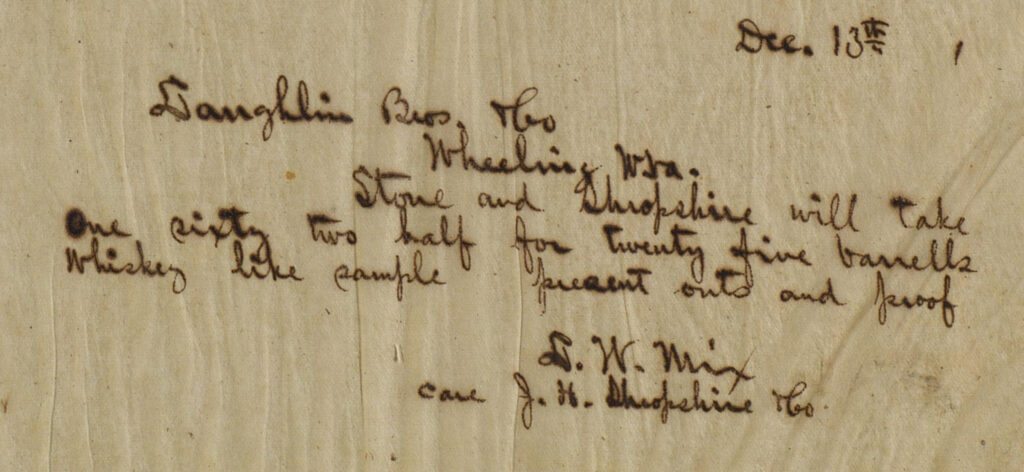

Compounding these problems was the fact that in the years following the 1868 act, distillery capacity increased, more barrels went into bond, the economy experienced a recession and soon enough a glut was created. This glut, in conjunction with the requirement to pay monthly taxes on barrels coming out of bond was exploited by the market. Buyers who knew distillers would need cash to cover monthly taxes began offering prices that would barely cover a distiller’s cost of goods—in some cases offering less than that. Distillers, needing to pay taxes as barrels came out of bond (sold or not), might find themselves forced to take these prices anyway just to keep up.

By the mid-1870s distilleries finding themselves in an increasingly insolvent situation began actively lobbying lawmakers in Washington, D.C. for some relief. After a few abortive attempts, the bonding period was extended to three years in 1878. Unfortunately for some distilleries, like Elkhorn, this came too late to save them. Also by this point distilleries in distress had either greatly curtailed or entirely ceased making whiskey, in part because they just couldn’t afford the raw materials. This finally stemmed the glut and buyers began to pay better prices once again.

Older and wiser distilleries?

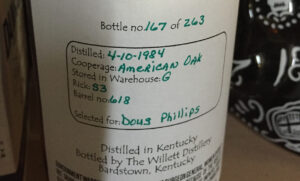

While the creation of the one year bonding period probably looked good on paper to everyone when the 1868 act was passed, it seems to have resulted in a large disturbance in the whiskey market—that plus all the new rules and regulations. Whether that was deliberate or not, that’s a matter for debate. It does seem that distillers experienced a steep learning curve as they grappled with the way the bonding period affected their cash flow. Distilleries that survived probably had learned to control their rate of production (i.e. avoid creating another glut) and how to manage aging stocks. [4] It also seems clear that buyers took unfair advantage of the situation for as long as it lasted. The change from one to three years of bonding when it finally came gave distilleries (that had survived) a chance to rebalance their books and replenish stocks of older and more valuable barrels.

—

Notes:

[1] Raitz’ book has been my constant reading companion for the last six months but all good things much eventually come to an end with fewer than 40 pages left to go. I will be more than a little sorry to put it behind me. It’s provided me with an incredible orientation to the wide variety the forces and currents, natural and man-made, that shaped and created today’s Bourbon landscape. I hope to give it a proper write up and review in the coming month.

[2] Construction of the distillery started in the years leading up to the 1868 legislation. It failed less than a decade later in 1874. Incredibly enough it’s original brick warehouse remains standing today. Here’s a link to a photo of it.

[3] There were plenty of other twists and turns that distilleries went through as a result of the act. Barrels coming out of bond each month had to be gauged to determine taxes and this could take significant amounts of time and labor. (This was before the advent of ricks so barrels were just stacked in the warehouse, separated by boards.) It also required the services of an on-site government employee, the Gauger. (Distilleries paid the salary of the Gauger—another expense.) Paperwork needed to be filled out and filed and then tax-paid certificates needed to be issued by the government and placed on the head of each barrel removed from bond. Local offices responsible for issuing the certificates were slow to do so or simply ran out of the certificates, holding up sales. Some buyers only wanted completely full barrels of whiskey, something the new rules hadn’t made an accommodation for. This meant new procedures (and paperwork) for topping up had to be implemented on the fly. And there were some buyers that only wanted whiskey of a certain (narrow) proof range, which meant gauging and cherry picking barrels before taking them out of bond. All of this added to a distiller’s overhead.

[4] Another unintended consequence, the one year bonding period eroded the stocks of whiskey much older than one year, which had always been more desirable. Those stock would need to be rebuilt to help stabilize the market.