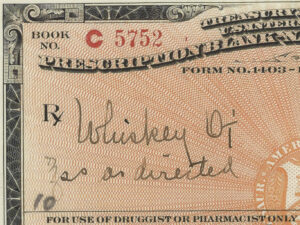

Today, December 5th, is the 89th anniversary of the end of national Prohibition after Ohio, Pennsylvania and Utah (!?) voted to ratify the 21st amendment. Interestingly enough the federal government had already begun the repeal process months earlier by enacting a law in March 21st of that year, known as the Harrison-Cullen Act, when it levied taxes (of course) on low-proof alcohol beverages. This was a de-facto re-legalization of both beer and wine [1]. (This is celebrated as National Beer Day. [2]) Complete unwinding of Prohibition once the 21st amendment was ratified was left to individual states and took some time. In fact, Mississippi remained dry until 1966. No pun intended, just a sobering look at the damages done.

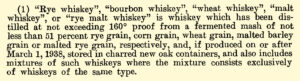

Also to the best of my knowledge only two distilleries were able to restart with any kind of speed after repeal: Stitzel in Louisville (which was one of the six medicinal whiskey permit holders during Prohibition) and Henry McKenna (which closed itself down in anticipation of Prohibition and remained solvent because of other family businesses).

In 1933 the federal government also established the so-called ‘three tier’ distribution system, which required a clean financial separation between beverage alcohol producers, distributors, and sellers. The intent was to prevent recreating certain ‘business as usual’ practices that existed prior to Prohibition. Such monopolistic tendencies had led to the creation in 1877 of the Distillers’ & Cattle Feeders’ Trust, also known as The Whiskey Trust. The Trust attempted to control whiskey prices by either buying up independent distilleries or forcing them out of business by artificially lowering wholesale prices [3]. Rules and regulations for the new system were published in 1935 as the Code of Fair Competition for the Distilled Spirits Rectifying Industry, part of the National Recovery Act (helping to rebuild the economy after the Great Depression).

Celebrate the change today but honor also all that was lost.

—

Notes:

[1] Note the use of the term ‘nonintoxicating liquors’ in this act. The original text of the 18th amendment called for prohibition on ‘intoxicating liquors’ which technically did not include beer and wine. In fact, the expectation of many who voted to ratify the amendment was that beer and wine would remain legal. The Volstead Act, which gave the force of law to the amendment when passed, wound up also including beer and wine: so, surprise! This means technically the federal government was not violating the original intent of the 18th amendment by levying this new tax. Also by the time the legality of the act might have been challenged in court, the 21st amendment had been ratified. So kind of tricky on the part of the federal government.

[2] Actually celebrated April 7th, since this was the day the Harrison-Cullen Act came into effect.

[3] The Trust didn’t ever actually go out of business. It continued to operate during Prohibition as American Medicinal Spirits, one of the six medicinal whiskey permit holders. After repeal, AMS (as it was known) metamorphosed into the more benign entity known as National Distillers.